Contact Us

|

-

WeChat

Wechat:13689585250Scan contact us

|

- |

- 400-0808-600

Wechat:13689585250Scan contact us

Trade declaration

Customs refers to the process by which the consignee and consignor of import and export goods, the person in charge of inbound and outbound transportation, the owner of inbound and outbound articles, or their agents go through customs procedures for the entry and exit of goods, articles or transportation devices and related customs affairs, including customs Declare, submit documents for inspection, and accept customs supervision and inspection. Customs declaration is one of the necessary links in fulfilling customs entry and exit procedures. customs clearance:

Our professional customs declaration staff wholeheartedly provide customers with customs declaration agency services for export goods.

1. Acting for clients to handle general export customs declaration business;

2. Provide customs declaration business consulting services and customs declaration solutions;

Advantage:

1. Fast document production and delivery;

2. High-quality customs brokers: have a comprehensive understanding of customs declaration-related policies, and have strong business operation capabilities and enthusiastic and professional services;

Export tax rebate:

1. Meaning:

Export Rebates (Exemption, Export Rebates) tax, abbreviated as export tax rebate, its basic meaning refers to the refund of the value-added tax and consumption tax actually paid in domestic production and circulation for export goods. The export goods tax rebate system is an important part of a country's taxation. Export tax rebates are mainly used to balance the tax burden of domestic products by refunding the domestic tax paid for exported goods, so that domestic products can enter the international market at a cost excluding tax, and compete with foreign products under the same conditions, thereby enhancing competitiveness and expanding exports Of foreign exchange.

2. Conditions:

(1) It must be goods within the scope of value-added tax and consumption tax. The scope of collection of value-added tax and consumption tax includes all value-added taxable goods other than tax-exempt agricultural products directly purchased from agricultural producers, as well as 11 categories of consumer goods that are subject to consumption tax, such as tobacco, alcohol and cosmetics. This condition must be met because export goods tax refund (exemption) can only be refunded or exempted for goods that have been levied on value-added tax and consumption tax. Goods that have not been levied value-added tax and consumption tax (including goods exempted from taxation by the state) cannot be refunded, in order to fully reflect the principle of "no refund if not collected".

(2) It must be the goods that have been declared for export. The so-called export refers to the export gateway, which includes two forms of self-support export and entrusted agency export. Distinguishing whether goods are declared to leave the country for export is one of the main criteria for determining whether goods fall within the scope of tax refund (exemption). Unless otherwise stipulated, goods sold in the country without customs declaration and departure, regardless of whether the export enterprise settles in foreign currency or RMB, and regardless of how the export enterprise handles it financially, shall not be regarded as export goods and be refunded. For goods sold in China that receive foreign exchange, such as hotels, restaurants, etc., goods that receive foreign exchange, etc., because they do not meet the conditions for leaving the country, no tax refund (exemption) can be given.

(3) It must be the goods that have been sold financially. Export goods can only be refunded (exempted) after they are processed for export in financial terms. In other words, the export tax rebate (exemption) regulations only apply to trade export goods, and for non-trade export goods, such as donated gifts, goods purchased by individuals in the country and brought out of the country (if otherwise specified) Excluding), samples, exhibits, mailed items, etc., as they are generally not financially processed for sale, they cannot be refunded (exempted) in accordance with the current regulations.

(4) It must be the goods that have been collected and written off. According to current regulations, export goods for which export enterprises apply for tax refund (exemption) must be goods that have received foreign exchange and have been verified by the foreign exchange administration. The state stipulates that the goods exported by foreign trade enterprises must meet the above four conditions at the same time. Production enterprises (including production enterprises with import and export rights, production enterprises that entrust foreign trade enterprises to export as agents, and foreign-invested enterprises, the same below) must add a condition when applying for tax refund (exemption) for exported goods, that is, apply for refund (exemption) The taxed goods must be self-produced goods of the production enterprise or deemed self-produced goods to be refunded (exempt).

3. The attached materials:

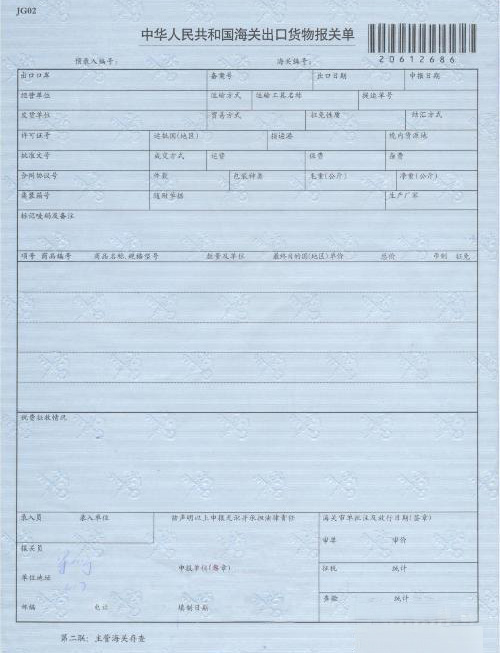

1. Customs declaration. The customs declaration form is a document filled out by the importer and exporter to the customs when the goods are imported or exported, so that the customs can check and release it.

2. Export sales invoices. This is the document issued by the export company based on the sales contract signed with the export buyer. It is the main certificate for foreign purchases, and it is also the basis for the accounting department of the export company to use this account to make the sales income of export products.

3. Purchase invoice. The main purpose of providing purchase invoices is to determine the supply unit, product name, unit of measurement, quantity of the export product, and whether it is the sales price of the manufacturer, so as to divide and calculate the purchase fee.

4. Foreign exchange settlement bill or foreign exchange receipt notice.

5. It is a manufacturing enterprise that directly exports or entrusts the export of self-made products, and if the settlement is CIF, the export goods waybill and export insurance policy should also be attached.

6. Enterprises that have the business of processing and re-exporting products with imported materials should also report to the tax authority the contract number and date of the imported materials and parts, the name and quantity of the imported materials and parts, the name of the re-exported products, the amount of the cost of the imported materials, and the amount of actual payment. Kind of tax amount, etc.

7. Product taxation certificate.

8. Certificate of verification of export receipts.

9. Other materials related to export tax rebates.

export documents:

Need to provide commercial invoice, packing list, customs declaration information, export certificate, battery letter (when battery is available)

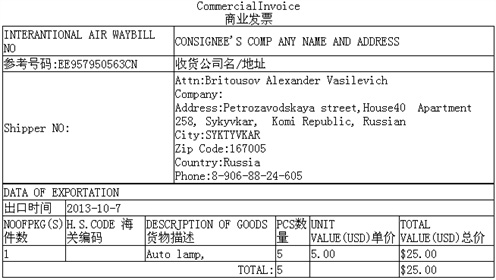

Commercial invoice template (for reference only)

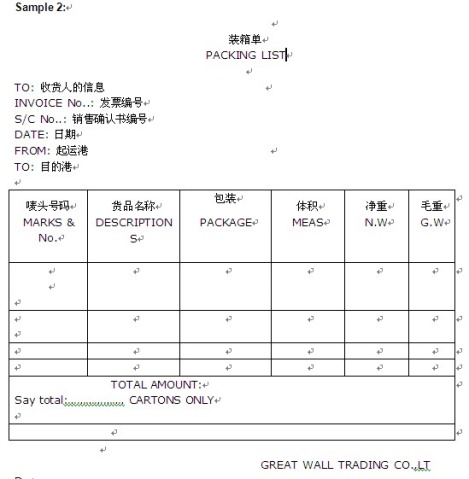

Packing list template (for reference only)

National Advisory Hotline

400-0808-600

Mailbox:

Cell phone:13827499398

Complaint Hotline:13689585250

Address:1st Floor, Building B-8, Xinfu Industrial Park, Chongqing Road, Heping Community, Fuhai Street, Baoan District, Shenzhen

Copyright © Shenzhen Runchengtong International Freight Forwarding Co., Ltd. All rights reserved Case number:Guangdong ICP No. 13088011